Choosing the right auto insurance provider is an important skill for car owners to have as it is necessary for them to be adequately protected in the event of accidents, theft, or natural disasters. The wrong choice could result in inadequate coverage or poor customer service when you need it most. Understanding how to pick the right provider can save you time, money, and stress in the long run.

Knowing the criteria for selecting an insurance provider is essential because it helps you make informed decisions. It ensures you get the best value for your money and the most appropriate coverage for your needs. This knowledge also helps avoid potential pitfalls and financial losses. In this guide, we listed the best tips to know how to pick the right auto insurance provider for you.

What is Auto Insurance?

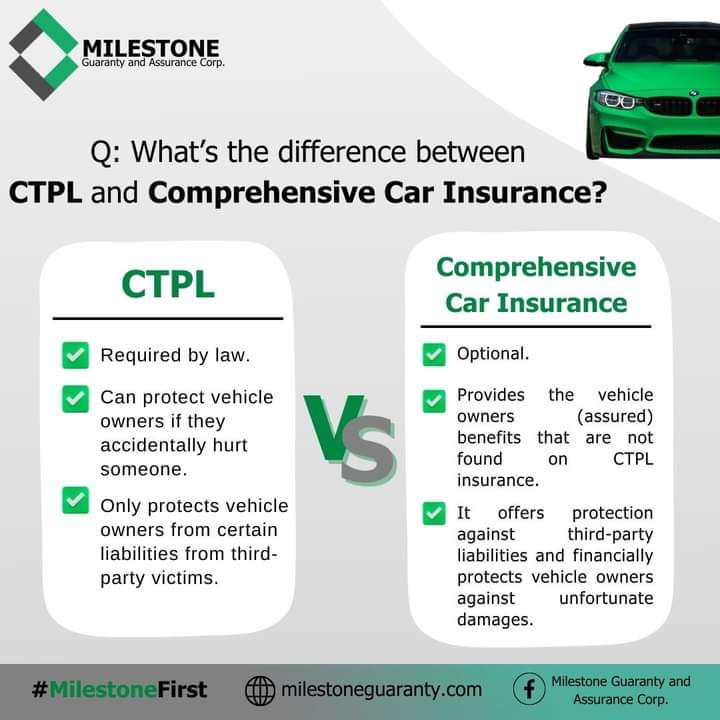

An auto insurance is a policy that provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could arise from incidents in a vehicle. In the Philippines, car insurance is mandatory, with the basic requirement being the Compulsory Third Party Liability (CTPL) coverage. This is mandated by the Land Transportation Office (LTO) and is necessary for vehicle registration.

CTPL covers third-party damages, but comprehensive car insurance can extend coverage to include first and second-party damages. Comprehensive insurance is optional, but it can offer more protection as it can also cover acts of nature, theft, and personal injuries. This broader coverage ensures better protection for car owners.

How to Choose the Right Auto Insurance Providers

Choosing the right auto insurance provider is essential for protecting yourself and your vehicle. With numerous options available, it’s best to understand what makes one insurer better suited to your needs than another. This guide will help you identify key factors to consider when selecting an auto insurance provider.

Step 1. Determine Coverage Needs

Identify the type and amount of coverage you need based on your car, location, and personal preferences.

Step 2. Set a Budget

Determine how much you can afford to spend on premiums.

Step 3. Research Providers

Look for providers with good reputations, financial stability, and customer service ratings. It’s best if you can find the LTO-accredited auto insurance providers.

Step 4. Compare Quotes

Get multiple quotes to compare prices and coverage options.

Step 5. Check for Discounts

Inquire about available discounts to lower your premium costs.

Dos and Don’ts

When selecting an auto insurance provider, there are key dos and don’ts to consider. Following these tips can help you make an informed decision and avoid common pitfalls. Here are some tips to help you choose the best insurance provider for your needs.

Dos

- Research the Company’s Reputation

Look for reviews and ratings from independent agencies and past customers to gauge the insurer’s reliability and customer service.

- Compare Multiple Quotes

Obtain quotes from several insurance companies to compare coverage options and pricing.

- Check Financial Stability

Verify the insurer’s financial strength through rating agencies like A.M. Best or Moody’s to ensure they can pay claims.

- Understand the Coverage

Make sure you fully understand what each policy covers and excludes, including any optional add-ons.

- Ask About Discounts

Inquire about available discounts for safe driving, bundling policies, or being a loyal customer.

Don’ts

- Don’t Base Your Decision Solely on Price

The cheapest policy may not provide adequate coverage, leaving you vulnerable in case of an accident.

- Don’t Overlook the Fine Print

Carefully read the terms and conditions to avoid unexpected limitations or exclusions in your coverage.

- Don’t Ignore Customer Service

Choose a provider known for good customer service, especially when it comes to handling claims.

- Don’t Skip Reviewing the Deductible

Make sure the deductible amount is affordable for you in case you need to file a claim.

- Don’t Neglect Checking State Requirements

Ensure the policy meets or exceeds your state’s minimum insurance requirements.

Video: How to Select Car Insurance Philippines

To better understand how to choose the right auto insurance provider, watch this informative video from Kuya Shane. It explains the key factors to consider, common mistakes to avoid, and tips for maximizing your coverage. Visual aids and real-life examples make the process easier to grasp.

Summary

Choosing the right auto insurance provider involves assessing your coverage needs, setting a budget, researching and comparing providers, and checking for discounts. It’s important to read reviews, verify credentials, and ask questions to ensure you get the best service. Avoid making decisions based solely on price, overlooking fine print, or rushing the decision-making process. By following these guidelines, you can find an insurance provider that offers reliable protection and excellent customer service in times when you need it most—in cases of emergency.